Menu

Wall Street Mastermind Jobs Database

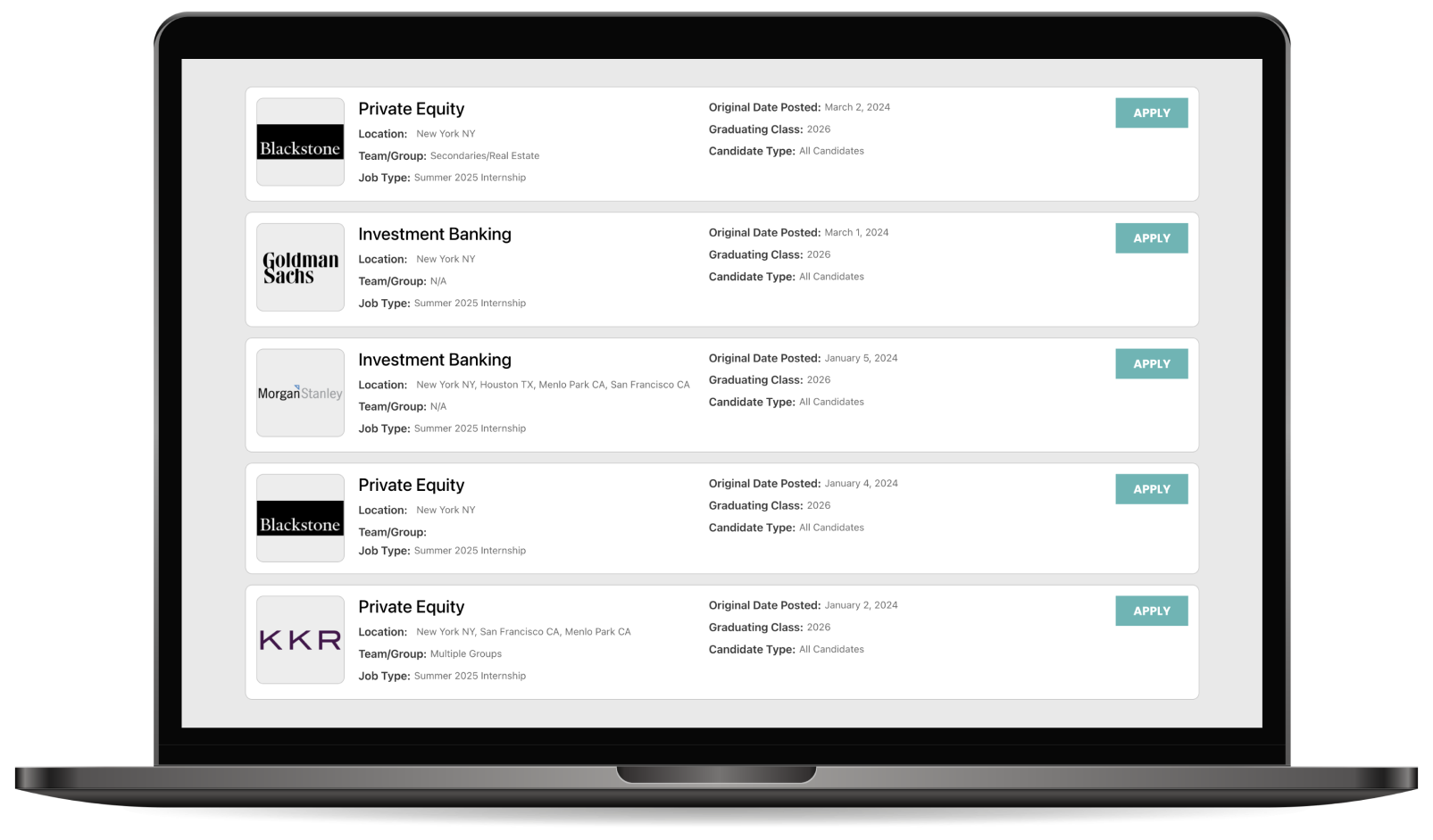

We find all the best opportunities on Wall Street and bring them right to you

How Will This Database Help You

Achieve Your Goals?

If you’re a college student who has aspirations of working for the most prestigious firms on Wall Street after graduating - whether that’s a bulge bracket or elite boutique investment bank, a megafund private equity firm, or any of the other top buyside investing firms - then this database was designed to help you with one of the most important steps of your recruiting process

Having worked with thousands of students over the last several years, we quickly realized that one of the biggest challenges for students is staying on top of all the different firms, when their applications open, and what the deadline is to apply. After all, there are hundreds of firms out there, each with multiple offices and groups that are hiring, and they all operate on their own unique timelines. To make matters worse, there isn’t one source of truth you can go to see all of the job opportunities. Some can be found on the firm’s career website, others post on major job sites like Linkedin and Glassdoor, while still others post on school-specific sites like Handshake.

So we initially decided to create this database to help the students we are coaching in Wall Street Mastermind. But after seeing how helpful this resource is for our own students, we wanted to make it available to everyone else as well. We understand how busy you must be already - from keeping your grades up in school, to stacking relevant experiences on your resume, to networking with the employees at your target firms, to prepping for the interviews - you’re being asked to do a lot. We hope this database makes the recruiting process a little bit easier for you - at least by making sure that you don’t miss out on any of the best opportunities that are available.

You never know, but any of the jobs posted in this database could end up being the offer that you ultimately end up with!

Check out the

Wall Street Mastermind Jobs Database

Before you sign up for our jobs database, first check it out to see the hundreds of job opportunities that are available and make sure it’ll be useful for you

Does this Sound Helpful to you?

Sign Up to Get Access to this Database Now

Once you’re signed up, you will get access to new internship opportunities that we will add each week. We will also send you an email with the weekly additions to make sure you don’t miss out on any opportunities.

What Industries are the Jobs/Internships in

the Database From?

Investment Banking

Equity Research

Capital Markets

Corporate/Commercial Banking

Private Equity/Credit

Other Buyside Roles(hedge funds, growth equity, venture capital)

Within the Industries Covered

Here are some examples of firms that we track internship opportunities for:

Bulge Bracket Investment Banks

Elite Boutique Investment Banks

Middle Market Banks

Private Equity/Credit

Other Buyside Roles

Bulge Bracket Investment Banks

Elite Boutique Investment Banks

Middle Market Banks

Private Equity/Credit

Other Buyside Roles

Does this Sound helpful to you?

Sign Up to Get Access to this Database Now

Once you’re signed up, you will get access to new internship opportunities that we will add each week. We will also send you an email with the weekly additions to make sure you don’t miss out on any opportunities.

What Kind of Jobs/Internships Can You Expect to Find in this Database?

We primarily focus on the following types of opportunities:

What are they: Most of the large firms (i.e. bulge bracket, elite boutique, and middle market banks) now have various initiatives that are primarily designed to attract Diversity and Inclusion (“D&I”) candidates earlier on in your college careers. D&I is usually defined as any candidate who identifies as some or all of the following: female, LGBTQ+, Black, Hispanic, Native American, disabled, veteran, and in some rare instances, first generation college students. If you fall into one of these categories and are still an underclassman, you want to pay attention to these opportunities as they can fast track you to your junior summer internship offer.

The shorter “Early Insights” programs usually last anywhere from a day or two, with some being more stretched out over several weeks. These events give students the opportunity to learn more about the firm, meet and network with employees from different teams, attend various professional development workshops, and often also come with an opportunity to interview with the firm at the end of the event.

The sophomore summer internships take place between your sophomore and junior year, and usually come with a return offer for the junior summer internship if you perform well. And even if you don’t get a return offer to your sophomore summer internship, simply having a sophomore summer internship from a brand name firm on your resume will put you head and shoulder above the rest of your competition. So this is essentially a fast track to an amazing junior summer internship offer, if not from the firm you’re doing the sophomore summer internship at, then certainly at another top tier firm.

When to be on the lookout for these opportunities: All throughout freshman year, plus the first semester of sophomore year.

What are they: All the top firms on Wall Street use the junior summer internship as the primary recruiting pipeline to fill their full-time entry-level positions. This is because it’s a lot less risky to hire someone after trying them out over a 9-10 week summer internship, as opposed to just giving them an offer based on a couple of interviews. Statistically, you have the highest probability of landing a full-time offer from a top tier firm on Wall Street if you are able to land a junior summer internship first, as 80-90% of the full-time offers are typically given to returning interns. So this should be your focus as long as you’re not starting too late.

When to be on the lookout for these opportunities: If you’re targeting a top tier firm, applications start trickling out as early as halfway through sophomore year or even slightly earlier than that. Most top buyside firms and elite boutiques finish recruiting by the end of sophomore year before your sophomore summer starts. Some bulge bracket banks will recruit through the end of sophomore summer. Middle market firms are completely done by the end of the first semester of junior year. The bottom line is – if you’re hoping to get into a top tier firm, the period between the spring semester of sophomore year and the fall semester of junior year will be the most critical time for you. After that, there may be some opportunities that reopen here and there due to candidates accepting an offer and then reneging, but the longer it takes to land an offer, the more scarce the opportunities become.

What are they: This is the ultimate goal – a full-time position for you to work in upon graduation, typically with an “analyst” title if you’re just graduating from college. The people recruiting for full-time positions typically fall under one of the following categories: 1) did a summer internship and received a return offer, but want to move to a better firm, 2) did a summer internship but did not receive a return offer, so have to re-recruit, or 3) did not do a summer internship on Wall Street but still hoping to break in. The degree of difficulty varies based on your specific situation, but generally speaking full-time recruiting will be much more competitive than summer internship recruiting.

When to be on the lookout for these opportunities: Most top tier firms try to fill their full-time positions as soon as the summer internship ends in early August. At that point, they will know how many of the available full-time positions have already been filled by returning summer interns. Any remaining spots will be filled through a quick full-time recruiting process, and only the groups that still have a need will be recruiting. Most full-time process will be completely finished within 1-2 months. After that, you should only expect the top tier firms to recruit for additional full-time positions if there is a significant change in market conditions (i.e. deal flow significantly increases coming out of a recessionary environment). Otherwise, you will most likely have to move downstream to smaller firms and get your foot in the door there.

Does this Sound Helpful to you?

Sign Up to Get Access to this Database Now

Once you’re signed up, you will get access to new internship opportunities that we will add each week. We will also send you an email with the weekly additions to make sure you don’t miss out on any opportunities.